A survey tracking lifestyle consumption drivers & trends in the world’s most dynamic consumer markets

March 11, 2024 – Bluebell Group, Asia’s leading brand distributor and operator, released its fourth volume of the “Asia Lifestyle Consumer Profile 2024”, tracking the evolving consumption drivers & trends across the world’s most dynamic consumer markets. Based on an Asia-wide survey covering 1,750 premium lifestyle consumers across six markets – Mainland China, Japan, South Korea, Hong Kong, Taiwan and Southeast Asia (Singapore and Malaysia).

The 2024 report focuses on understanding the concept of value: how Asian consumers perceive the value of luxury brands amidst global instability and economic uncertainties. Against the backdrop of the pandemic’s aftermath, the study explores the significant shifts in consumer behaviours and values, with emerging trends towards redefining lifestyles, emphasising well-being, sports, spirituality and experiential pursuits.

Overall, there has been no noticeable drop in positive consumer sentiment this year across Asia, with China maintaining a consistently high level of optimism in the past 4 years at 97%, and Southeast Asia witnessing a remarkable surge, with 93% of respondents expressing positivity about the future in 2024, an increase of 17% since 2021. Japan has also marked a dramatic increase in expressing ‘positivity about the future’ of 25% since 2021.

The three major findings this year are:

- Value appreciation: A consumer mindset focused on reputation, quality AND investment value

The survey distils a shifting luxury paradigm in Asia, marked by a consistent emphasis on quality, reputation and a growing consciousness of the resale or investment value of a product.

Quality undeniably stands as the cornerstone of how consumers value luxury with the majority prioritising craftsmanship over brand or design. Over 70% of consumers in all markets agree that luxury is about the quality; notably China and Taiwan exhibit high agreement rates at 94% and 93%, respectively (Fig 1).

Concurrently, brand reputation continues to be a critical determinant in luxury purchases, with China at 96%, Southeast Asia at 91% and Taiwan at 90% (Fig 2).

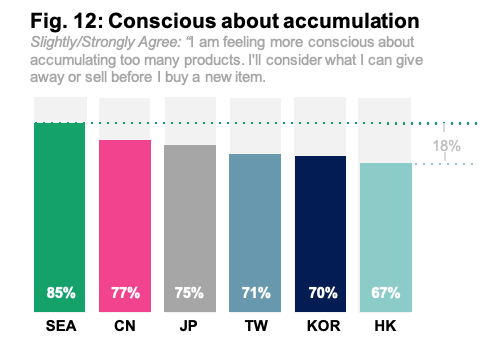

On average, 74% of consumers across the six markets express an inclination towards evaluating the resale value of their purchases before acquiring new items, with Southeast Asia leading the pack at 85% (Fig 12). This shift in mindset signifies a heightened appreciation for value-oriented consumption, where consumers prioritise products that maintain or appreciate their value over time. Consequently, they are inclined to invest monetarily more in fewer, high-value items rather than purchase a large quantity of products.

Furthermore, Asian consumer consciousness regarding accumulating too many products reflects a notable trend towards mindful consumption, and can be an indicator of a trend toward deeper evaluation of acquiring fewer products, focusing on those that have a perceived resale value.

Trend to watch: There is a growing acceptability among Asian consumers in support of Asian premium brands. China is leading the trend with a strong support rate of 85% for Asian premium brands, followed by Southeast Asia at 83%. Taiwan, Hong Kong and Korea also show varying degrees of support at 68%, 65% and 62%, respectively, while Japan shows relatively lower support at 51%. Despite these differences, consumers are increasingly recognising the quality and accessibility of Asian premium brands, signalling a shift in consumer preferences towards home-grown premium options (Fig 13).

- Quality of service: A consumer expectation not to be underestimated

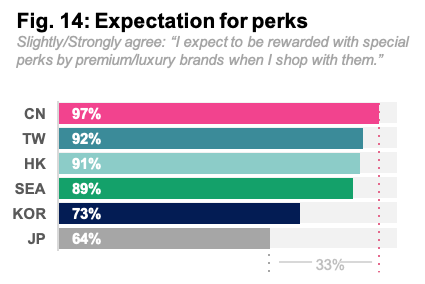

Asian consumers show a keen expectation in being rewarded with special perks by brands during their shopping journeys. China leads at 97%, followed by Taiwan at 92% and Hong Kong at 91%. Japan and Korea, however, display more modest agreement rates at 73% and 64%, respectively, suggesting there is still an expectation for perks, but not as prevalent (Fig 14).

The good news is that these highly sophisticated consumers are willing to accept rising prices, with the expectation that the brand delivers on the quality and craftsmanship of their products. China and Southeast Asia demonstrate strong acceptance of price increases, at 88% and 78%, respectively. In contrast, Korea (62%) and Japan (49%) are less accommodating, signalling a more discerning approach to price increases (Fig 15).

Examining in-store service preferences across Asia reveals distinct consumer inclinations:

These findings underscore the importance of tailoring service levels physically and beyond the store to meet the diverse needs and preferences of consumers across Asia. Consumers in the region, to varying degrees, are open to sharing their personal data if they feel they are getting quality service from the sales associate and some rewards. Brands need to offer an immersive brand experience and knowledgeable assistance, while also adapting to customers’ need for personal space and autonomy during their shopping journey.

- Pricing alignment: Channel agnostic consumers in search of the best price

When it comes to online shopping, consumer preferences diverge between favouring brand official websites and opting for multi-brand online platforms. China (59%), Korea (61%) and Taiwan (54%) predominantly prefer brand official websites, highlighting an inclination towards direct brand engagement and possibly in a search for authenticity. On the flip side, Japan (63%), Hong Kong (61%) and Southeast Asia (57%) exhibit a preference for multi-brand platforms, suggesting a higher value placed on choice, pricing and convenience (Fig 19).

Through a closer look at product categories, the survey findings also revealed that brand official websites are generally preferred for online shopping across most product segments. However, the beauty sector leans just slightly towards a preference for multi-brand platforms, while the jewellery & watches sector shows a distinct preference for brand official websites.

These findings point to a crucial insight for brands operating in Asia: The necessity to align on price consistency across different shopping channels to control brand image. Consumers are digitally savvy and will spend time comparing prices across platforms, and any inconsistencies can be a deterrent and potentially damage the brand’s reputation.

To download the full report, please visit

About Bluebell Group

Bluebell Group has pioneered building successful brands in Asia since 1954. As Asia’s partner of choice, Bluebell Group is present in Japan, South Korea, Mainland China, Hong Kong SAR, Taiwan, Macau SAR, Singapore, Malaysia, Cambodia and Australia.

The Group’s distribution network includes flagship stores, shop-in-shops, counters, its own multi-brand concepts, as well as a highly selective wholesale network, together with both direct e-commerce and marketplaces, covering both domestic and Travel Retail.

The Group operates across multiple product categories: Accessories, Footwear, Apparel, Fragrance, Beauty, Gourmet, Jewellery, Watches, Eyewear and Tobacco.

A family-owned group, Bluebell Group today has over 3,000 employees, 650 points-of-sale.

PRESS CONTACT

Anne Geronimi