A survey tracking lifestyle consumption drivers & trends in the world’s most dynamic consumer markets

October 2021 – Asia’s leading brand distributor and operator, Bluebell Group released today its latest market report focusing on the “Asia Lifestyle Consumer Profile”, tracking lifestyle consumption drivers & trends across the world’s most dynamic consumer markets.

“As lifestyle brands enter a new phase of planning post-COVID, there is a fundamental need to understand the differences and commonalities across Asia’s consumers’ outlooks”, said Bluebell Group President and CEO, Ashley Micklewright. “This is not just about the impacts of the pandemic on Asian consumer trends. It is about a region in evolution and each market within evolving differently, with regards to consumers’ state of mind, purchasing intent and preferences.In essence, this is a playbook for brands whether they have retail operations across Asia, or in specific Asian markets.”

Based on an Asia-wide survey covering 2,100 premium lifestyle consumers across six markets – Mainland China, Japan, South Korea, Hong Kong, Taiwan and Southeast Asia (Singapore and Malaysia) – the study sheds light on five leading consumer traits and consumption behaviours across the region, covering interest and intent for brand experiences, purchasing drivers, lifestyle behaviours, and product categories.

A mostly positive outlook

There is good news – on average, 80% of consumers across Asia say they are generally feeling positive about the future. Mainland Chinese consumers are almost universally positive (Fig. 1), owing no doubt to a short lockdown and a high public approval of pandemic-related measures. Japanese consumers, meanwhile, are much more mixed, with only 51% feeling positive about the future.

Tradition meets Neophilia

Whilst there is a sense of nostalgia and an importance of local relevance, a desire of novelty from brands is apparent – in both experiences and products. In Asia, the majority of markets show a strong interest for virtual products, though the preference is particularly marked among Mainland Chinese, Taiwanese and Hong Kong consumers, who are respectively the most interested (85%, 77% and 73%) in virtual products (Fig. 2)

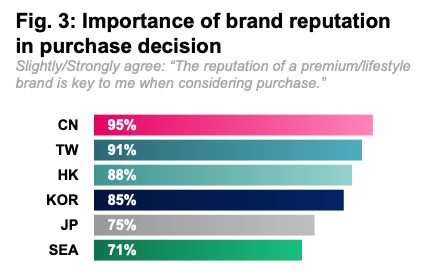

More traditional attitudes to brand reputation and luxury as a ‘reward’ are equally apparent. The importance placed on brand reputation is strongest in Mainland China, Taiwan and Hong Kong, and suggests a traditional attitude to luxury as a way to affirm status. The majority of consumers are also aligned in their purchasing behaviour: between 76% and 94% of consumers (from Southeast Asia and Mainland China, respectively), agree that they will buy luxury items as a reward to themselves.

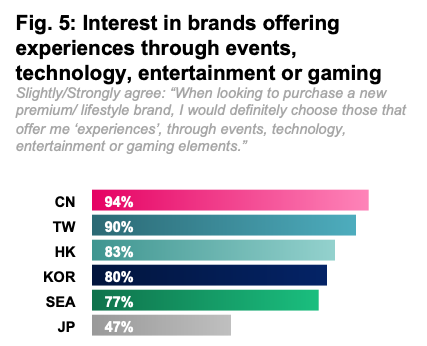

When it comes to experiences, consumers want it all. Bluebell Group’s survey found that 80% of consumers across Asia would choose to buy from premium or lifestyle brands that offer them experiences through events, technology, entertainment or gaming elements (Fig. 5). The feeling is almost universal in Mainland China, where 94% of respondents agree, followed by Taiwan with 90%, and Hong Kong (83%).

Specifically in fragrance, consumers show a desire to explore ‘niche’ brands: between 69% and 75% of consumers across Asia say they are now more interested in exploring more niche brands, at the exception of Japan, which once again appears the most conformist to established notions of luxury (Fig. 6).

Its naturally about me, mostly

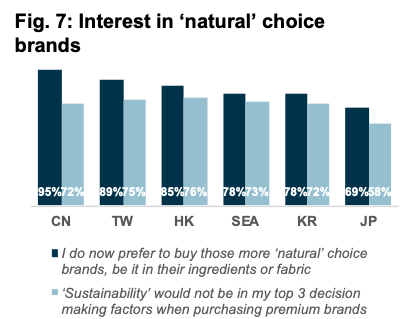

Healthy and active lifestyle are popular pursuits across the continent, and there is a sense that it is all centred around consumers’ individual desires – at this point, investing in natural products seems a better bet than a long-term plan towards sustainability. Along with the pursuit of health comes the pursuit of all things ‘natural’, with consumers across Asia preferring to buy more natural choice brands, be it in their ingredients or fabric. Again, this preference most prevalent among mainland Chinese consumers (95%), followed by those from Taiwan (89%) and Hong Kong (85%) (Fig. 7). Interestingly, this trend does not align with expectations on sustainability: over 70% of consumers in all markets except Japan say that ‘sustainability’ would not be in their top 3 decision making factors when purchasing premium brands.

Consumer traits

From Bluebell Group’s survey have emerged five consumers traits shared by large consumer groups across the six monitored markets in Asia:

Experientialist: Events, technology, entertainment, gaming, human or digital, they want to experience it all, and across all channels.

Culturalist: In tune with their own roots, they value brands who show local relevance in their branding and product.

Traditionalist: Luxury is still a way for them to affirm their status – both to the world and to themselves. By and large, for them niche is not the new luxury.

Comfort-me-ist: Health, home, natural – consumers care about self-improvement and self-enjoyment. While natural products are part of the mix, sustainability is not yet a top criteria in their consumption.

Neophilist: They thrive on novelty and are curious to explore new things, from mix and matching to virtual and second-hand products

To download the full report, please visit http://bluebellgroup.com/market-insights/.

About Bluebell Group

Bluebell Group has pioneered building successful brands in Asia since 1954. As Asia’s partner of choice, Bluebell Group is present in Japan, South Korea, Mainland China, Hong Kong SAR, Taiwan, Macau SAR, Singapore, Malaysia, Cambodia, and Australia.

The Group’s distribution network includes flagship stores, shop-in-shops, counters, its own multi-brand concepts, as well as a highly selective wholesale network, together with both direct e-commerce and marketplaces, covering both domestic and Travel Retail.

The Group operates across multiple product categories: Accessories, Footwear, Apparel, Fragrance, Beauty, Gourmet, Jewellery, Watches, Eyewear and Tobacco.

A family-owned group, Bluebell Group today has over 3,800 employees, 650 points-of-sale, US$2b in turnover.

PRESS CONTACT

Anne Geronimi, Group Communication Director