Tracking lifestyle consumption drivers & trends across Asia

May 2023 – Asia’s leading brand distributor and operator Bluebell Group released today the third volume of the “Asia Lifestyle Consumer Profile”. Based on an Asia-wide survey covering 1,765 premium lifestyle consumers across 6 markets, the study presents insights into evolving sentiments and trends shaping consumption across premium and luxury segments including fashion, accessories & footwear, beauty, fragrance & make-up, active lifestyle and jewellery & watch.

This year, three core trends have emerged in our study:

Trend 1 – ‘Safe’ luxury: after the storm, consumers find a new comfort zone

Figures suggest a resurgence of ‘traditional’ attitudes toward luxury, including the status that it represents, the importance placed on a brand’s reputation, and expectations on service. But markets show distinct comfort zones when it comes to shopping pre-owned, local and niche.

“During the pandemic, premium and luxury brands focused resources toward nurturing consumer relationships in new and innovative ways, through one-on-one interactions and other tailored retail solutions,” said Bluebell Group President & CEO Ashley Micklewright. “Going forward, we see consumers continue to expect this heightened level of service excellence, which is particular to Asia.”

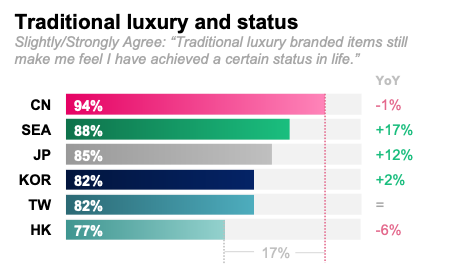

In 2023, luxury and status remain tightly interlinked in the minds of Asian consumers, led by Mainland China (94%) (above left). Interestingly, SEA and Japan saw high growths in consumers who agree that traditional luxury branded items make them feel like they have “achieved a certain status in life”.

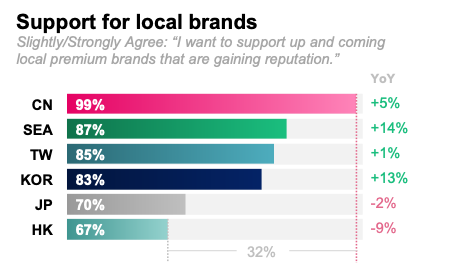

Meanwhile, support for local brands has grown across China (+5%), SEA (+14%), Korea (+13%) and Taiwan (+1%), where consumers agree they want to “support up and coming local premium brands that are gaining reputation” (above right).

Trend 2 – The ‘Feel Good’ value shift: Healthy, Natural, Ethical

Consumers want to feel good and make up for lost time. But where we might expect them to pursue simple hedonism, their definition of feeling good goes far beyond self-gratification.

“While we see a strong ‘revenge living’ mentality, consumers appear to consider ethical and sustainable values as important components in the pleasure of purchasing premium and luxury products. Today it is an expectation,” said Anne Geronimi, Group Communication and Sustainability Director.

Already high in 2022, interest in ‘natural choice’ brands (above left) rose in SEA (+6%), Mainland China (+4%) and Korea (+3%). In all markets except for Japan, over 85% of respondents agree that they now prefer to buy those more ‘natural’ choice brands, be it in their ingredients or fabric.

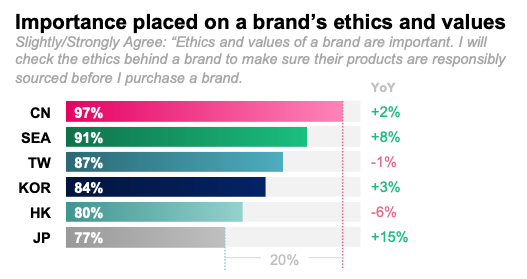

More widespread yet is the year-on-year growth in consumers who attach importance to brands’ ethics and values (above right)- a growth led by Japan (+15%, from 62% to 77%) and SEA (+8%, from 83% to 91%). Chinese respondents (97%) are the most likely to check the ethics behind a brand before they purchase it.

Trend 3 – New horizons: domestic and regional travel appeal

Even as international destinations court them, Chinese and Japanese consumers are drawn to local destinations. And while travellers from the rest of Asia are willing to spend on experiences, Chinese travellers still plan to spend most on shopping both abroad and at home.

“Travel and spending intent is good news for domestic destinations like Hainan in China, which invested heavily in the island’s infrastructure to cater to both consumer experiences and shopping offering during the pandemic,” said Samy Redjeb, Greater China Managing Director.

While domestic destinations are attracting some consumers away from international travel (see report), they elicit different spending intents among consumers, with experiences such as F&B, spa and concerts (above top) topping the planned spending categories for the region as a whole. Chinese consumers are the exception to the rule: they are most likely to spend on luxury fashion (44%), beauty & Skincare (44%) and jewellery & watches (41%) during domestic travel.

By contrast, spending intent during international travel is topped by luxury fashion, ranking first among consumers from Japan (67%), Korea (54%) and Taiwan (61%) (above bottom). Experiences (e.g. F&B, spa, concerts) rank second overall in Asia, and top the ranking for consumers from Hong Kong (64%).

To download the full report, please visit https://www.bluebellgroup.com/market-insights/.

ABOUT BLUEBELL GROUP

Bluebell Group has pioneered building successful brands in Asia since 1954. As Asia’s partner of choice, Bluebell Group is present in Japan, South Korea, Mainland China, Hong Kong SAR, Taiwan, Macau SAR, Singapore, Malaysia, Cambodia and Australia.

The Group’s distribution network includes flagship stores, shop-in-shops, counters, its own multi-brand concepts, as well as a highly selective wholesale network, together with both direct e-commerce and marketplaces, covering both domestic and Travel Retail.

The Group operates across multiple product categories: Accessories, Footwear, Apparel, Fragrance, Beauty, Gourmet, Jewellery, Watches, Eyewear and Tobacco.

A family-owned group, Bluebell Group today has over 3,800 employees, 650 points-of-sale, US$2b in turnover.

PRESS CONTACT

Anne Geronimi, Group Communication Director